President Yuk-Seol Yoon (center) attends a ground-breaking ceremony for Shin-Hanul Units 3 and 4. (Photo: South Korea presidential office)

The U.S. and South Korea have reached a provisional agreement and are working on a memorandum of understanding to advance the countries’ partnership on civil nuclear energy.

Catherine Cornand of Framatome and Chang Hee-Seung of KHNP (center) with Framatome and KHNP employees following the signing of the MOU. (Photo: Framatome)

Framatome and Korea Hydro & Nuclear Power (KHNP) have announced the signing of a memorandum of understanding to explore the possibility of producing the medical isotope lutetium-177 at KHNP’s Wolsong nuclear power plant in South Korea. The companies also will investigate the feasibility of using the plant to support Korean production of medical radioisotopes in the future.

South Korea’s Shin-Hanul-2 is on the right, with Unit 1 to the left. (Photo: KHNP)

Unit 2 of South Korea’s Shin-Hanul nuclear power plant entered commercial operation on April 5, Korea Hydro & Nuclear Power announced. It is the nation’s 26th operating reactor, which continues the upward nuclear trend as South Korea reverses a previous phase-out plan for nuclear.

Treated water is safer than world standards, essential for decommissioning

Washington, D.C. – The American Nuclear Society (ANS) supports the start of Japan’s controlled release of re-treated, diluted tritium wastewater into the sea from the Fukushima Daiichi Nuclear Power Plant (NPP), which sustained damage in the aftermath of a 2011 earthquake and tsunami.

From left: Hyundai E&C president and CEO Young-joon Yoon, Holtec president and CEO Kris Singh, South Korean minister of trade, industry and energy Chang-yang Lee, and K-Sure president and chairman Inho Lee. (Photo: Holtec)

Two South Korean financial institutions—the Korea Trade Insurance Corporation (K-Sure) and the Export-Import Bank of Korea (KEXIM)—have signed pacts with Holtec International and Hyundai Engineering & Construction (a Hyundai Motor Group subsidiary) to provide support to Holtec’s SMR-160 projects around the world, the American firm announced on May 2.

In a global market with different national regulations, on-site testing of power plant components can be complex. Thanks to smart glasses, remote testing should become easier.

March 29, 2023, 9:30AMNuclear NewsChristoph Gatzen and Simon Lemin VR glasses from manufacturer RealWear.

The challenges of climate change are bringing nuclear energy back into focus. Even in Germany, which decided on a general nuclear phaseout in 2011 as a response to the Fukushima disaster that year, nuclear energy is again being discussed as a bridging technology. Compared with fossil fuels, nuclear saves considerable greenhouse gases. However, for a holistic view of CO2 emissions from power plants, the procurement, maintenance, and repair of plant components must also be considered. At the very least, the CO2 emissions caused by the high costs of testing and maintaining a nuclear power plant can be reduced.

A rendering of a NuScale VOYGR plant. (Image: NuScale)

NuScale Power, the Portland, Ore.–based small modular reactor developer, announced last week that it has placed the first upper reactor pressure vessel (RPV) long-lead material (LLM) production order with South Korea’s Doosan Enerbility.

South Korea’s Shin-Hanul-1 (on left) and -2. (Photo: KHNP)

Unit 1 at South Korea’s Shin-Hanul nuclear power plant entered commercial operation last week, Korea Hydro & Nuclear Power has announced. The 1,340-MWe APR-1400—designed by KHNP and parent firm Korea Electric Power Company—achieved initial criticality on May 22 of this year and was connected to the grid on June 9.

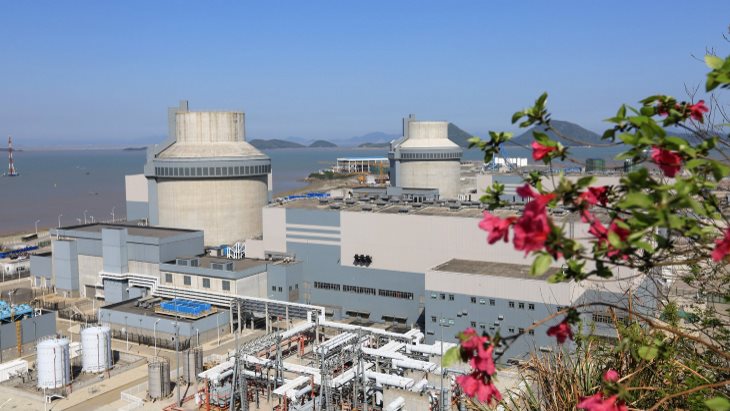

The CANDU reactors at Qinshan. (Photo: Wikimedia/Atomic Energy of Canada Limited)

SNC-Lavalin subsidiary Candu Energy recently announced that it is engaged in pre-project design and engineering work at the Qinshan Phase III nuclear power station in China’s Zhejiang Province with Third Qinshan Nuclear Power Company (TQNPC), the plant’s operator.

Artist's rendering of Shin-Hanul Units 3 and 4. (Image: KHNP)

South Korea’s new president, Yoon Suk-yeol, appears to be following through on his campaign pledge to reverse the previous administration’s domestic nuclear phaseout plan. Earlier this month, Yoon’s Ministry of Trade, Industry, and Energy announced a new direction for the nation’s energy policy—one that calls for, among other things, a reembrace of nuclear power. A further announcement on the subject last week provided additional details.

The world's first AP1000 reactors to enter operation, Sanmen units 1 and 2, in China. (Image: Westinghouse Inc.)

Westinghouse Electric Company and South Korea’s Hyundai Engineering & Construction have signed an agreement to “jointly participate in global AP1000 plant opportunities,” the Pennsylvania-based nuclear technology firm announced on May 24.

As energy security and environmental concerns prompt some countries to increase their reliance on nuclear energy or become first-time adopters of the technology, the U.S. government must decide whether it will offer financing for reactor exports—a move that poses financial risks but could create jobs, address global climate and energy security challenges, and limit Chinese and Russian influence. A new

As energy security and environmental concerns prompt some countries to increase their reliance on nuclear energy or become first-time adopters of the technology, the U.S. government must decide whether it will offer financing for reactor exports—a move that poses financial risks but could create jobs, address global climate and energy security challenges, and limit Chinese and Russian influence. A new

-2018.jpg)